The job market is uncertain, and layoff announcements from major companies are becoming more common. Whether you’re feeling layoff anxiety or already have a timeline for your departure, now is the time to strengthen your financial safety net.

Looking for a smart strategy? A certificate of deposit (CD). While CDs are typically associated with long-term savings, they can also be a powerful tool before, during, and after a layoff. Here’s how a CD can help you when job security is in question.

1. Use CD Interest for Monthly Income

A common concern during a layoff is maintaining cash flow. Many people don’t realize that CDs can provide regular monthly income—without withdrawing the principal.

When you open a CD, you can set it up to pay out interest monthly instead of letting it compound. This means your CD will provide a steady stream of funds that you can use to help cover essential expenses while searching for a new job. Alternatively, suppose you keep the interest in the CD but later find yourself needing cash. In that case, you can withdraw the interest earned that has already been posted to the CD anytime without penalty.

2. Lock in Higher Interest While You Still Have a Paycheck

If you suspect layoffs are coming—or are fortunate to have received notice of an upcoming layoff – you can use a short-term CD to maximize your savings before your income changes.

A short-term CD allows you to earn a higher interest rate compared to a regular savings account while ensuring your money is available when you need it. For example, if you have six months before your layoff, you could open a 6-month CD that matures just as you’ll need those funds. This strategy helps you grow your emergency fund faster while keeping your savings secure.

3. Prioritize Liquidity While Earning More

An emergency fund is critical in uncertain times, but keeping all of your cash in a standard savings account means missing out on higher returns. Instead, consider splitting your emergency savings:

- CD’s may have a penalty for early withdrawal. Keep some in a no-penalty CD, which typically pays a higher rate than a savings account and allows you to withdraw funds early without facing early withdrawal penalties and fees.

- Put a portion in a short-term CD to earn a better rate while keeping funds accessible when needed.

- Open a simple CD ladder that sets up CDs maturing every quarter which will provide you with a higher rate than a savings account and quarterly liquidity. Note, that most CDs have low minimum opening balance requirements, some as low as $100, so opening a CD ladder doesn’t necessarily take a lot of funds.

- Consider a CD-secured loan if you need funds but don’t want to break your CD early. Many banks and credit unions allow you to borrow against your CD at a lower interest rate than personal loans or credit cards, providing a cost-effective way to access cash without losing your locked-in interest earnings.

This approach ensures that your money is working for you, while still being available if a layoff happens.

4. Shop Around for the Best CD Rates

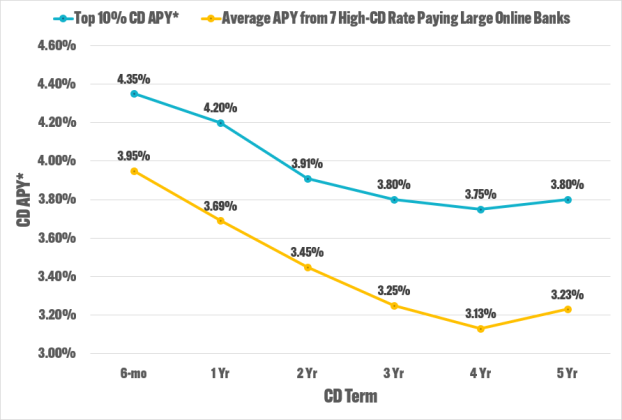

Your primary bank – the one where you deposit your paycheck and have your debit card or checking account – is not always the best place for your CDs. This is especially the case if you bank with the nation’s largest financial institutions. CD Valet’s latest data from March 20, 2025, shows a significant gap in Annual Percentage Yields (APYs) between the most competitive standard CD rates offered and those from large online banks. The top 10% rate for a 1-year CD on CD Valet currently sits at 4.20%, while the average APY for seven of the large online banks is 3.69%. This trend also extends to longer terms, with 5-year CDs in the top 10% offering 3.80% APY, compared to just 3.23% from major online banks. Savers looking to shop for the top 10% of the most competitive standard term rates can earn an average of 54 basis points versus rates from large online banks.

To maximize your earnings, take the time to research and compare the best CD rates. Credit unions and community banks often provide higher yields than online banks. Websites like CD Valet make it easy to compare options and find the best rates.