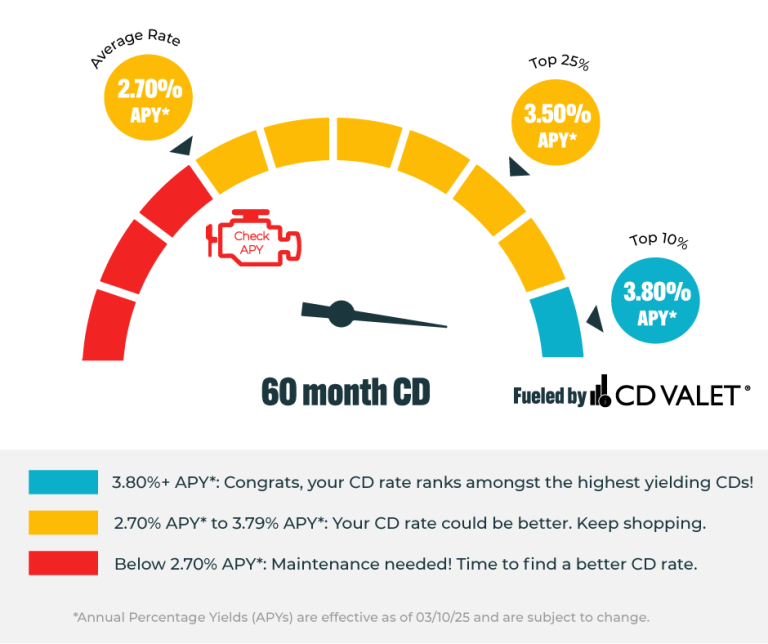

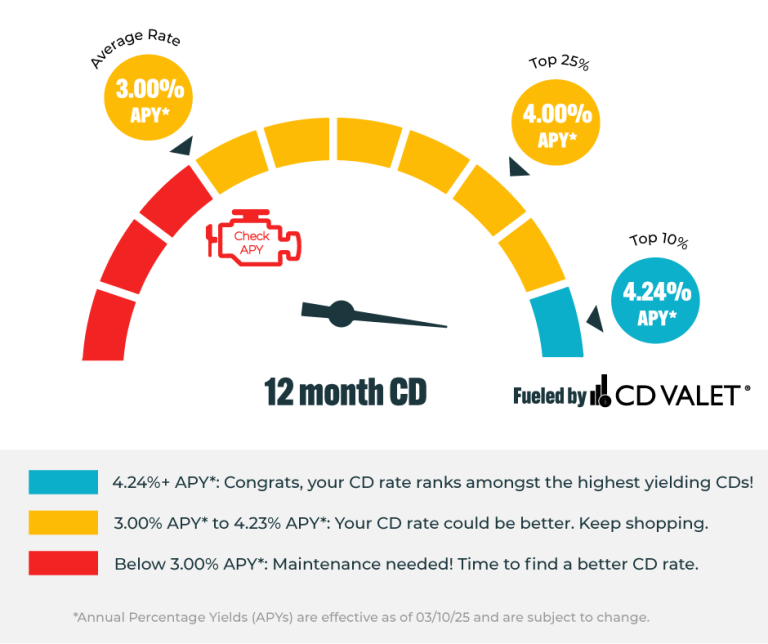

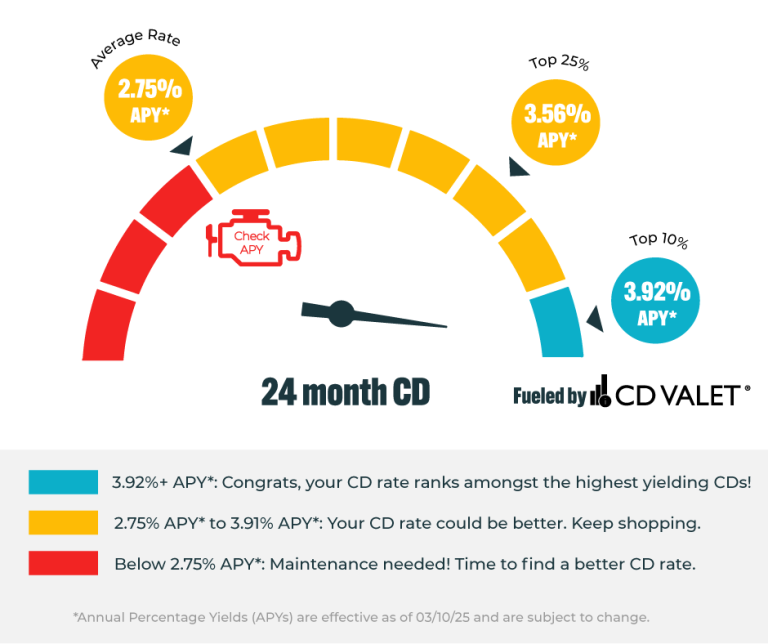

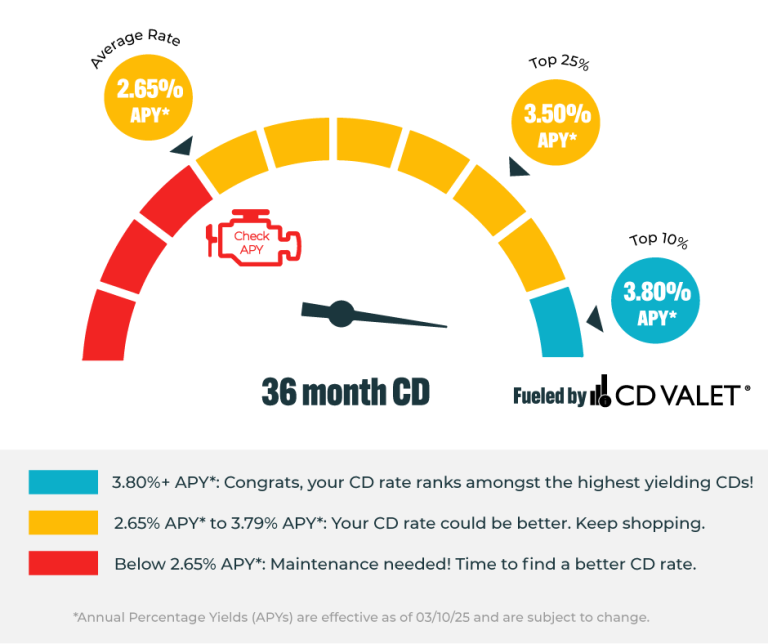

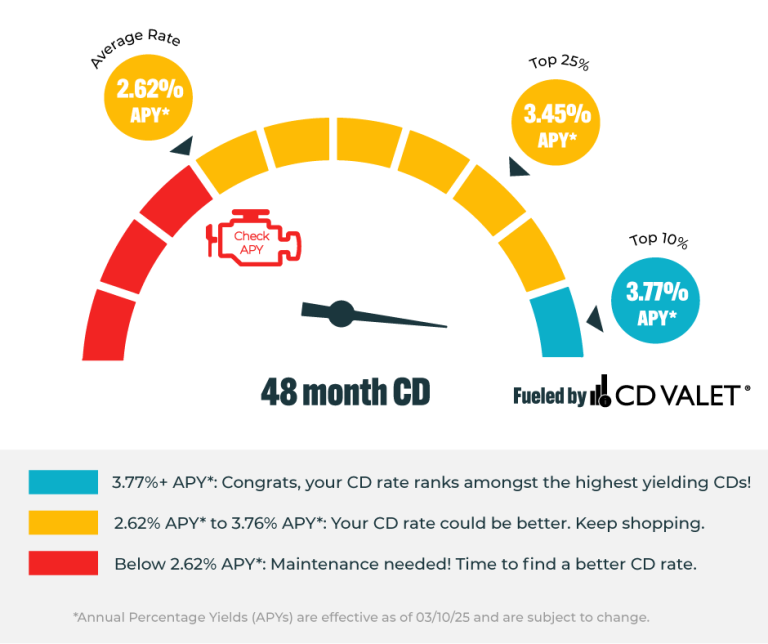

Before locking in that ideal CD rate, check out the March APY Checkpoint to determine if the rate you’re considering ranks among the top 10% of annual percentage yields (APYs) for standard terms. The checkpoint features data from CD Valet’s Market Intelligence Tool — updated monthly – and provides a clear benchmark to ensure you’re earning the most competitive returns.

Strategic CD Approaches to Consider

A well-planned CD strategy is best paired with top rates and is essential for optimizing returns while maintaining financial flexibility.

1. Lock in Long-Term Rates – Securing a 3-year or 5-year CD can ensure strong returns for years to come, protecting your savings from future declines.

2. Maintain Liquidity with Short-Term CDs – A 6-month or 1-year CD allows you to lock in today’s competitive rates while keeping funds accessible for reinvestment if market conditions change.

3. Build a CD Ladder – Spreading funds across multiple maturities provides steady returns while ensuring regular liquidity. A laddering strategy balances long-term earnings with short-term flexibility.

Are you earning the highest returns possible?

Use the APY Checkpoint to see how your rate compares to the best available options.